The second round of Paycheck Protection Program (PPP) funding is available to taxpayers borrowing funds for the first time, who have 500 or fewer employees and who have experienced a decline in gross receipts of at least 25% in any one quarter of 2020 versus the same quarter of 2019. This funding is also available to sole proprietors, not-for-profits, self-employed individuals, and independent contractors who are first-time borrowers. The amount available to these taxpayers is up to 2.5 times their average monthly payroll costs incurred in the one-year period prior to the date of the loan. In this second round of funding, if the taxpayer is a restaurant or hotel, the amount available is up to 3.5 times their average monthly payroll costs incurred in the one-year period prior to the date of the loan.

The second round of Paycheck Protection Program (PPP) funding is available to taxpayers borrowing funds for the first time, who have 500 or fewer employees and who have experienced a decline in gross receipts of at least 25% in any one quarter of 2020 versus the same quarter of 2019. This funding is also available to sole proprietors, not-for-profits, self-employed individuals, and independent contractors who are first-time borrowers. The amount available to these taxpayers is up to 2.5 times their average monthly payroll costs incurred in the one-year period prior to the date of the loan. In this second round of funding, if the taxpayer is a restaurant or hotel, the amount available is up to 3.5 times their average monthly payroll costs incurred in the one-year period prior to the date of the loan.

Borrowers who received funding from the first round of PPP are also eligible for a second round of funding if they have 300 or fewer employees, experienced a decline in gross receipts of at least 25% in any one quarter of 2020 versus the same quarter of 2019, and they have already used or will use the full amount borrowed during the first round of PPP funding. New and second-time borrowers will only be able to receive up to $2 million in loans, as opposed to the $10 million they were eligible for in the first round.

Taxpayers who receive these PPP loans must spend at least 60% of the loan proceeds on payroll costs during the covered period in order to be eligible for loan forgiveness.

Deductibility of eligible business expenses funded with a PPP loan

The COVID-related Tax Relief Act of 2020 (COVIDTRA) clarifies the rules from the CARES Act for the deductibility of expenses paid with PPP loan proceeds. Taxpayers are now allowed to deduct those expenses paid for using PPP funds. The COVIDTRA also expanded expenses for second-time borrowers that are eligible deductions for loan forgiveness purposes to include the following:

- Covered supplier costs – payments to suppliers of goods that are necessary to the operations of the taxpayer’s business at the time of purchase

- Covered operations expenditures – payments for any software or cloud service used to conduct business operations

- Covered property damage costs – costs related to property damage/vandalism/looting that occurred during 2020 that weren’t covered by insurance or other compensation

- Covered worker protection expenditures – costs incurred to restructure business activities to comply with requirements/guidance issued by the Department of Health and Human Services, CDC, OSHA, or any state/local government

Changes to PPP loan relief applications, including a simplified loan forgiveness process for loans of $150,000 or less

The loan forgiveness application for those taxpayers who borrowed $150,000 or less will now fill out a simpler forgiveness application, no more than one page in length, that requires information such as the total amount of loan proceeds received, the amount of loan proceeds that were spent on payroll costs, and the number of employees retained due to receiving the loan. Borrowers must retain supporting documentation for the loan forgiveness information for at least 4 years, should a determination be made that the taxpayer will be subject to an audit of its use of the PPP loans.

- Paycheck Protection Program Second Draw Borrower Application Form (released 01-08-21)

For more information about the PPP, contact our professionals at 315.424.1120.

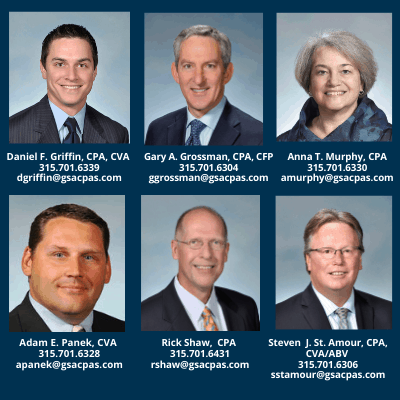

ABOUT GROSSMAN ST. AMOUR CPAs PLLC

Grossman St. Amour CPAs PLLC virtual doors are open and we are assisting clients with audit, accounting, and tax issues as well as matters relating to COVID-19. As a certified public accounting firm located in central New York, Grossman St. Amour CPAs has been in business for 63 years.

Grossman St. Amour CPAs provides businesses and individuals with accounting, audit, taxation, business planning and valuation, financial planning, investment consulting, and fraud examination and deterrence services. For more information about how Grossman St. Amour CPAs PLLC can be of service to you, contact our professionals.