Buying a home is the single largest financial commitment most people ever make. And sorting through mortgages involves making a lot of critical choices. One of these is choosing between a fixed- or variable-interest-rate mortgage.

Buying a home is the single largest financial commitment most people ever make. And sorting through mortgages involves making a lot of critical choices. One of these is choosing between a fixed- or variable-interest-rate mortgage.

True to its name, fixed-rate mortgage interest is fixed throughout the life of the loan. In contrast, the interest rate on a variable-interest-rate loan can change over time. The mortgage interest rate charged by a variable loan is usually based on an index, which means payments could move up or down depending on prevailing interest rates.

Common Indexes

The most common indexes to which the interest on adjustable-rate mortgages is pegged are the 1-Year Constant Maturity Treasury Index, the 12-month Treasury average, the Cost of Funds Index, and the London Interbank Offered Rate Index.

Fixed-rate mortgages have advantages and disadvantages. For example, rates and payments remain constant despite the interest-rate climate. But fixed-rate loans generally have higher initial interest rates than variable-rate mortgages; the financial institution may charge more because if rates go higher, it may lose out.

If prevailing interest rates trend lower, a fixed-rate mortgage holder would have to refinance, and that may involve closing costs, additional paper work, and more.

With variable-rate mortgages, the initial interest rates are often lower because the lender is able to transfer some of the risk to the borrower; if prevailing rates go higher, the interest rate on the variable mortgage may adjust upward as well. Variable-rate mortgages may allow borrowers to take advantage of falling interest rates without refinancing.

One of the biggest advantages variable-rate mortgages offer can be one of their biggest disadvantages as well. Rates and payments are subject to change, and they can rise over the life of the loan.

Should you choose a fixed or variable mortgage? Here are four broad considerations:

First, how long do you plan to stay in the home? If you plan on living in the home a short time before selling it, you may want to consider a variable-rate mortgage. With a shorter time frame, the loan will have less time to move up or down.

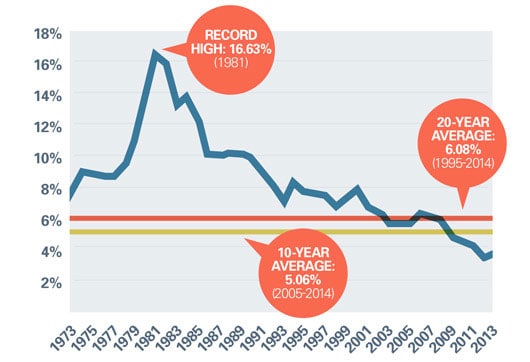

Second, what’s happening with interest rates? If interest rates are below historic averages, it may make sense to consider a fixed rate. On the other hand, if interest rates are above historic averages, it may make sense to consider variable rate loan. Then if interest rates decline, your interest rate may fall as well.

Third, under what conditions can the lender adjust the rate and payment? How frequently can it be adjusted? Is there a limit on how much it can be adjusted in each period? Is there a lifetime limit on how high the interest rate and payment can be raised?

And fourth, could you still afford your monthly payment if interest rates were to rise significantly? How would it affect your finances if your payment were to rise to its lifetime limit and stay there for an extended period?

For most, buying a home is a major commitment. Selecting the most appropriate mortgage may make that long-term obligation more manageable.

Fast Fact: Death Pledge?

The word “mortgage” comes from the Old French words “mort”, meaning “dead”, and “gage”, meaning “Pledge.”

Average Interest Rate: 30-Year Fixed-Rate Mortgages

According to Freddie Mac, the average rate on 30-year fixed-rate mortgages is up in recent years, but still below historical averages.

Source: Nerdwallet

ABOUT GROSSMAN ST. AMOUR CPAs PLLC

Grossman St. Amour CPAs PLLC virtual doors are open and we are assisting clients with audit, accounting, and tax issues as well as matters relating to COVID-19. As a certified public accounting firm located in central New York, Grossman St. Amour CPAs has been in business for 63 years. The firm provides businesses and individuals with accounting, audit, taxation, business planning and valuation, financial planning, investment consulting, and fraud examination and deterrence services. For more information about how Grossman St. Amour CPAs PLLC can be of service to you, contact our professionals.

Grossman St. Amour CPA PLLC provides the information on this website and social media platform for general guidance only. The firm does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles on this platform are not intended to be used, and cannot be used by any taxpayer for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is”, with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose.