Under the CARES act, passed in March 2020, Congress passed two programs to help businesses keep employees on the payroll throughout the pandemic, the Payment Protection Program (PPP) and the Employee Retention Credit (ERC). The employers who took the forgivable PPP loan, however, were not eligible for the ERC. Under the new stimulus package, the Consolidated Appropriations Act (CAA) passed on December 21, 2020 businesses are now allowed to take advantage of both the PPP and the ERC. This is in effect for the first two quarters of 2021, as well as retroactively back through March of 2020.

Under the CARES act, passed in March 2020, Congress passed two programs to help businesses keep employees on the payroll throughout the pandemic, the Payment Protection Program (PPP) and the Employee Retention Credit (ERC). The employers who took the forgivable PPP loan, however, were not eligible for the ERC. Under the new stimulus package, the Consolidated Appropriations Act (CAA) passed on December 21, 2020 businesses are now allowed to take advantage of both the PPP and the ERC. This is in effect for the first two quarters of 2021, as well as retroactively back through March of 2020.

To be originally eligible for the Employee Retention Credit under the CARES Act, the employer must have had either their operations fully or partially suspended due to a government ordered COVID-19 lockdown or a 50% decline in gross receipts for any quarter of 2020 as compared to the same quarter of 2019. To qualify for the ERC under the CAA for 2021, employers – including tax exempt organizations – must have experienced either operations fully or partially suspended due to a government ordered COVID-19 lockdown or a 20% decline in gross receipts for either Q1 or Q2 of 2021 as compared to the same quarter of 2019.

Originally under the CARES Act, affiliated companies that shared common ownership were not allowed to take the credit – if one company received a PPP loan, any other company with more than 50% common ownership was ineligible. The wages used to calculate the ERC must be wages in excess of those used on the PPP loan forgiveness application. Since this has been deemed retroactive, if employers paid excess wages above and beyond those claimed for PPP forgiveness in 2020, they can file amended payroll tax returns to claim the credit, as well as amend returns for affiliated companies since they are now allowed to claim the credit as well. This is a great opportunity for employers to benefit for both programs, however this may require analysis of 2020 wages and your PPP loan forgiveness application to determine eligibility.

Under the CAA the amount of the credit increased from 50% of qualifying wages paid to the employee (and the cost to provide health benefits) now to 70%. The maximum amount of credit originally was capped at $5,000 ($10,000 in qualified wages x 50% limit) but has now been increased to $7,000 per quarter ($10,000 in qualified wages x 70% limit), for a maximum of $14,000 in 2021. Businesses are also now allowed to increase pay (raises, hazard pay, etc.) and still claim the credit.

The Treasury is now allowing advance payments of the credit for employers who have fewer than 500 employees based on 70% of the average quarterly payroll for the same quarter of 2019. However, if the amount of the actual credit determined at the end of the quarter is less than what was estimated, the excess credit received in advance must be repaid to the government.

The ERC is taken on form 941 against payroll taxes. The 2020 ERC can be claimed on the 4th quarter 941 rather than having to amend previous quarters. To the extent that the ERC is in excess of the amount of payroll taxes due, Form 7200 should be filed to receive a refund.

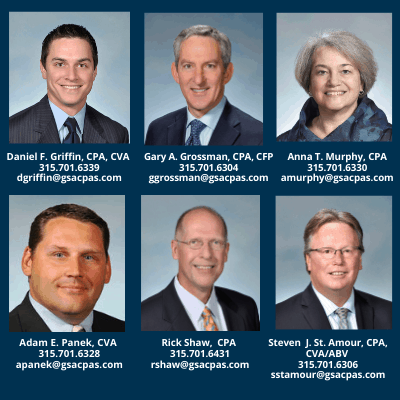

If you believe you might be eligible for the 2020 ERC, please contact us to determine the next best steps to take. Also, make sure to analyze your 2021 gross revenue for Q1 and Q2 for the 20% decline, and contact us if you believe you’ll be eligible for those benefits. As with all stimulus changes, clarifications and new guidance is constantly emerging. Please be sure to check our website or future developments.